Although it is a truism, this article must begin by highlighting the importance of airports as connections between different domestic and international markets. Therefore, investment in airport infrastructure (whether new facilities or remodelling/expanding existing facilities) is a key factor in world economic development.

Adopting a PPP model for airport management offers many advantages, and these result in economic development of the region the airport serves.

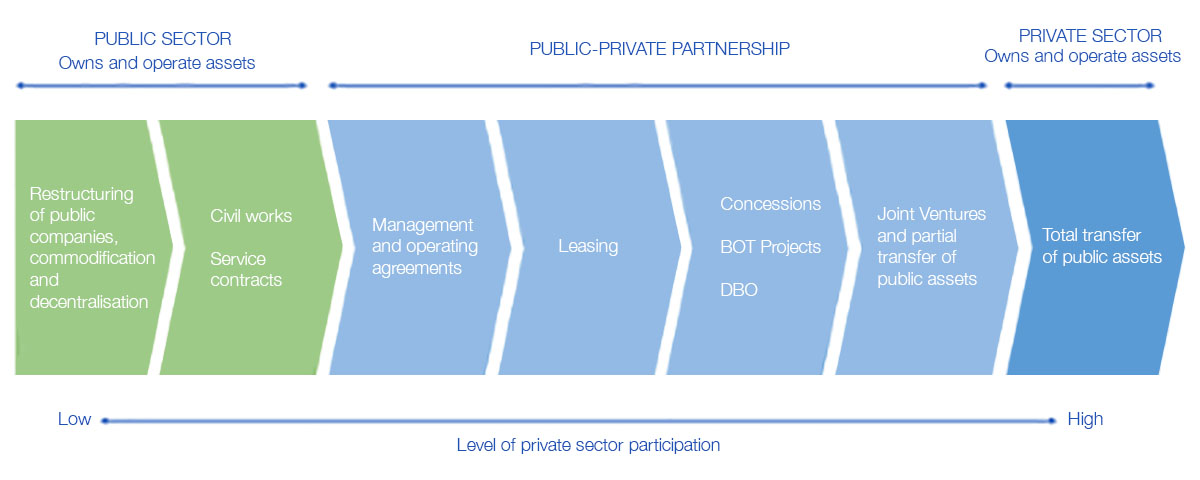

Traditionally, airport infrastructures were owned by different governments (the public sector), which also handled management and operation. However, in recent years, this trend has shifted towards greater private sector participation, modulated by different degrees of ownership, responsibility and management models. Public-Private Partnership (PPP) lies within these management models.

But what exactly are Public-Private Partnerships?

In reality, there is no consensus on a definition for Public-Private Partnership (PPP). In general terms, a Public-Private Partnership refers to an agreement between the public and private sectors in which part of the services or functions that are the responsibility of the public sector are administered by the private sector by means of a clear agreement regarding the shared objectives for providing the public service or infrastructure.

A growing number of countries include a definition of Public-Private Partnership in their laws, adapting their definition to the institutions and particular features of their legislation. Countries with their own PPP laws include the following:

| AFRICA | AMERICA | EUROPE | ||

| Angola | Argentina | Bulgaria | ||

| Benin | Brazil | Croatia | ||

| Cameroon | Canada | Czech Republic | ||

| Egypt | Chile | France | ||

| Ghana | Colombia | Greece | ||

| Kenya | Mexico | Ireland | ||

| Madagascar | Peru | Kosovo | ||

| Malawi | USA | Latvia | ||

| Morocco | Lithuania | |||

| Mauritania | ASIA | Macedonia | ||

| Mauricio | Cambodia | Poland | ||

| Mozambique | Philippines India | Spain | ||

| Senegal | Indonesia | Romania | ||

| South Africa | Jordan | |||

| Tanzania | South | OCEANIA | ||

| Tunisia | Korea | Australia | ||

| Zambia | Sri Lanka | Fiji | ||

| Vietnam |

The graphic below displays in greater detail, the range of agreements that would normally be classified as PPP projects:

In other words, the agreements defined as PPP projects are as follows:

- Management and operation agreements

- Leases

- Concessions, BOT and DBO projects

- Joint Ventures and partial transfer of public assets

- Agreed upon mixtures of the aforementioned options

Therefore, PPP’s do not include service contracts or turnkey contracts; these are considered as public contracting projects or privatisation of public services.

Principal considerations for the PPP model in airports

These are some of the main advantages to using PPP models in airports:

- Provide additional financing via private sector.

- Provide better infrastructure solutions (usually) than totally public or totally private initiatives, as each side focusses on its speciality and area of expertise.

- Complete projects more quickly, and reduce delays in infrastructure projects, due to early completion bonuses which increase efficiency.

- Provide greater flexibility in airport management, due to reduced administrative and bureaucratic procedures that can slow down decision-making.

- Evaluate risks completely and from additional viewpoints to determine project viability. In this respect, the private side can serve as an additional control for unrealistic public sector expectations.

- Transfer operating and project execution risks from the public to the private sector, which generally has more experience controlling and reducing infrastructure project costs.

All of the actors in this sector are aware that, in recent years, the PPP model is consolidating itself as a successful operating model for many airports. An example of this are the congresses and seminars that are promoted internationally to raise awareness of this approach. The Malaga Airport Forum (MAF) is a case in point, where the PPP model was expressly addressed, and the conclusions of the roundtable discussion were of particular interest (read more)

Among other things, the following aspects related to the PPP model were discussed:

- Principal challenges that large PPP initiatives must face

- Principal drivers and triggers that must be considered in order to maximize the possibilities for success of a PPP initiative

- Regions and markets that lead the way in terms of successful execution of PPP projects

- Regions and markets with more PPP project opportunities in the future

- Non-financial risks of a PPP transaction, for both public and private parties

- Importance of airport environmental and sustainability issues in PPP projects

Public-Private Participation model: the future of airport management

As explained, adopting a PPP model for airport management offers many advantages, and these result in economic development of the region the airport serves.

Furthermore, in recent years, this model is consolidating itself as a successful operating model for many airports, putting the model’s theoretical advantages into practice.

Finally, in the short term, we will see more and more PPP models in the airport sector, thereby increasing collaboration between the public and private sectors.